When your Annual Statement from your superannuation fund arrives it may be tempting to put it straight into the drawer. Your superannuation is either already your most valuable asset, or will be by the time you reach retirement age.

When your Annual Statement from your superannuation fund arrives it may be tempting to put it straight into the drawer. Your superannuation is either already your most valuable asset, or will be by the time you reach retirement age.

Your details

Firstly, make sure your details are up to date – your name, address, other contact details & your Tax File Number (TFN). If your superannuation fund doesn’t have a record of your TFN, you may pay a higher rate of tax on your contributions.

Beneficiaries

Check your beneficiary and update them if needed. A super fund may offer different types of nominations.

- Non-binding nomination – You may direct the Trustee to whom your benefit is paid to, but the Trustees have the final decision. They will take into account all claimants and check your will.

- Binding nomination (lapsing) – The Trustees are bound to pay your benefit to who you have nominated, providing you renew every 3 years.

- Binding nomination (non-lapsing) – The Trustees are bound to pay your benefit to who you have nominated, however you do not need to renew every 3 years.

Under Superannuation Law, the person(s) you nominate can only be a spouse (including defacto), Child (including adult children, step and adopted children), Financial dependent, or someone in an interdependent relationship with you at the time of your death. Otherwise you can make the nomination to your estate (and ensure your will is up to date).

Insurance

Review your insurance cover. Is your level of cover still appropriate? Do you need to increase your cover to take into account a change in your income or commitments?

The most common types are Death only, Death and Total & Permanent Disablement (TPD), and Income Protection. Some also offer Trauma cover. The type of cover could either be:

- Automatic insurance cover – This is a minimum level of cover without filling in forms.

- Units – The value of each unit depends on your age (decreases as you get older) and the premiums remain the same. You can increase the number of units you have.

- Fixed – The level of insurance cover remains the same and the premiums increase as you get older.

Investment Strategy

Does your investment strategy still suit your risk profile? Your investment strategy should match your long term investment goals. If you are considering an investment switch, it may be best to speak to a Financial Planner to explain the implications of your decision.

Fees

What are you paying fees for and how much are you paying? Do the fees include financial advice or is that extra?

What about multiple super funds from previous employers? Or do you have lost super because you changed your name or address. If you have more than one fund, then each super fund will be charging you fees. Most super funds can provide you with a “Combine your super form” which you will need to complete for each fund you want to rollover into to your existing super fund.

Employer Contributions

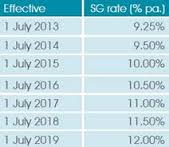

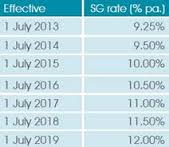

Have a look at your super contributions. Are they up to date? You can check your payroll slips and make sure that the amount being paid is the same as what is going in. Superannuation Guarantee (SG) Contributions commenced from 1 July 1992. At that time, employers either paid 3% or 4% (depending on total amount of payroll) of your gross salary into your super account. Since then the rate has gone up steadily. It was sitting at 9% for a while, but from 1 July 2013, employers need to pay 9.25%. Under legislation, your employer must pay at least quarterly. If not, follow up with your payroll office.

Generally, you’re entitled to super guarantee contributions from an employer if you’re 18 years old or over and paid $450 or more (before tax) in a month. It doesn’t matter whether you’re full time, part-time or casual or a temporary resident of Australia. If you’re under 18 you must also work more than 30 hours per week to be entitled to super contributions. If you’re a contractor paid wholly or principally for your labour, you’re considered an employee for super purposed and entitiled to super guarantee contributions under the same rules as employees.

From January 2014, your employer will pay into a “MySuper” authorised account if you do not choose a super fund. If you are eligible to choose a fund, your employer must give you a standard choice form.

If your employer forwards member voluntary contributions into your super fund on your behalf, they must be paid into your super fund with 28 days of the end of the month in which they take it from your pay.

Add extra contributions to your super

Adding extra to your super early in your working life means that compounding interest will help your balance grow. Your employer contributions will probably not be enough to ensure your final balance is enough for retirement. There are several ways to add extra to your super:

Concessional (before-tax) contribution

Known as Salary Sacrifice. You sacrifice part of your salary for extra employer contributions which are then taxed at 15% instead of your normal tax rate.

The general concessional (before tax) contributions cap for 2013-14 is $25,000.

However, from 1 July 2013 if you are 59 years old or over on 30 June 2013, additional concessional contributions will be able to be made to your super, with the cap increasing from $25,000 to $35,000.

From 1 July 2014, the higher cap of $35,000 will also apply to people who are 50 years or over.

Non-Concessional (after-tax) contribution

Also known as a personal contribution. You can make a personal contribution to your super (even if you are not working) as long as you are under 65 years of age. If you are age 65 -75 you can only make a personal contribution of you satisfy the work test.

The non-concessional contributions cap for 2013–14 is $150,000. If you are under 65 years old for at least one day of a financial year, you can ‘bring forward’ two years’ worth of contributions, giving you a total non-concessional contributions cap of $450,000 for the three years, rather than a $150,000 cap in each year of the three years.

This may enable you to:

- Claim a Tax deduction if you are self-employed, up to $25,000 per year.

- If you’re a low-to-middle income earner, the government could help boost your super savings through the super co-contribution and the low income super contribution. However, if you claim a deduction for all of your personal contributions, you won’t be eligible for a super co-contribution.

Spouse contribution

A tax offset may apply to a spouse if a spouse makes a contribution to a non-working or low-income-earning spouse super fund, whether married or de facto.

The spouse may be able to claim an 18% tax offset on super contributions of up to $3,000. The maximum tax offset is up to $540 each financial year.

Ready or not, the end of the year is fast approaching and now is the perfect time to start thinking about the year ahead.

Ready or not, the end of the year is fast approaching and now is the perfect time to start thinking about the year ahead.

When your Annual Statement from your superannuation fund arrives it may be tempting to put it straight into the drawer. Your superannuation is either already your most valuable asset, or will be by the time you reach retirement age.

When your Annual Statement from your superannuation fund arrives it may be tempting to put it straight into the drawer. Your superannuation is either already your most valuable asset, or will be by the time you reach retirement age.