Finance for every life stage

The life journey

We understand that financial goals will shift as each client’s situation changes to serve their current needs. Some needs will be long-term. For instance, saving for retirement takes place across decades. But that doesn’t make shorter goals, such as saving for a deposit on a home, any less challenging. Knowing what financial milestones to target and when, will help finance brokers ensure that they respond to a client’s needs as they arise.

Stage 1 – Getting onto the property ladder – purchasing the first home

Housing affordability generally in Australia has become, and will continue to be a significant issue for local property buyers. In particular those looking to buy in the Sydney and Melbourne markets, now two of the least affordable major metropolitan markets in Australia.

While home ownership rates in Australia have been in gradual decline for a few years now, the rate of decline has occurred much faster in younger households (such as the 25-34 year old age bracket). In Melbourne and Sydney the rapid rise in house prices has significantly outstripped income growth, meaning a bigger deposit is required. In our current low-wage growth environment combined with rapidly increasing house prices and low levels of housing on the market, this is easier said than done.

More and more young Australians are relying on the “Bank of Mum & Dad” for their first home deposit and will continue to do so, therefore like any “Bank”, it is important that Mum & Dad’s investment is secured ensuring their generosity does not go up in smoke.

Stage 2 – Getting Hitched

Once upon a time in towns and suburbs across Australia, couples were hitched in local churches and receptions were held in back yards or neighbourhood halls or even local footy clubs. It was a pretty simple affair, for family and a few good friends.

But today’s weddings are more outlandish trends consisting of, just to name a few, tropical island destinations, photo booths, drone photography, celebrity chef-designed menus, trendy food vans, and even photo shoots the day before the nuptials.

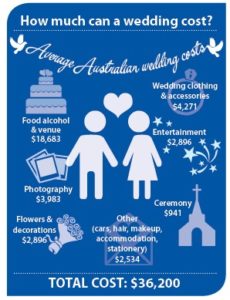

There are statistics and surveys that identify the average cost of a wedding in Australia and they can range from anywhere between $36,000 and $65,000.

So how much can a wedding cost?

If the Bride and Groom are lucky enough to have either or both sets of parents contributing to the cost, then it’s relatively simple to sit down and determine what funds are available to pay for the convoy of motorbikes and the luxury cars for the bridal party and a plane towing a sign of congratulations.

However, if they are amongst the many Australians who are getting married later in life, they are not relying on their parents – but rather on their disposable incomes and reasonable equity in their homes. They are part of a growing normality in 2016.

Source: La Trobe Financial